Tax Filing (April 15th deadline)

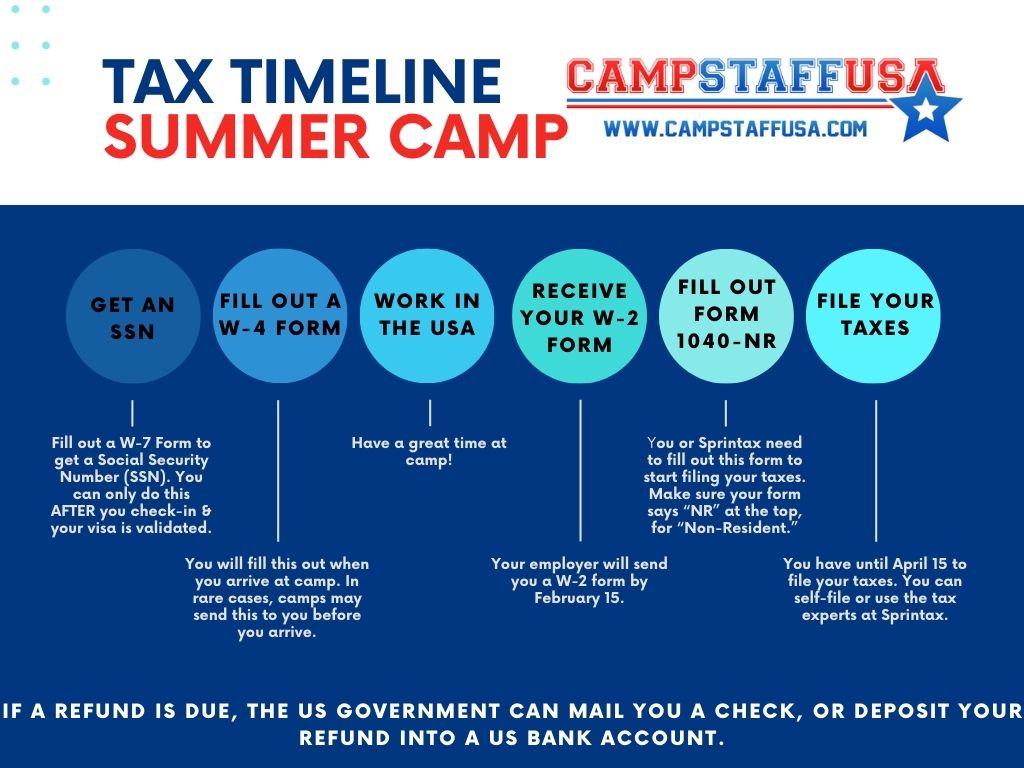

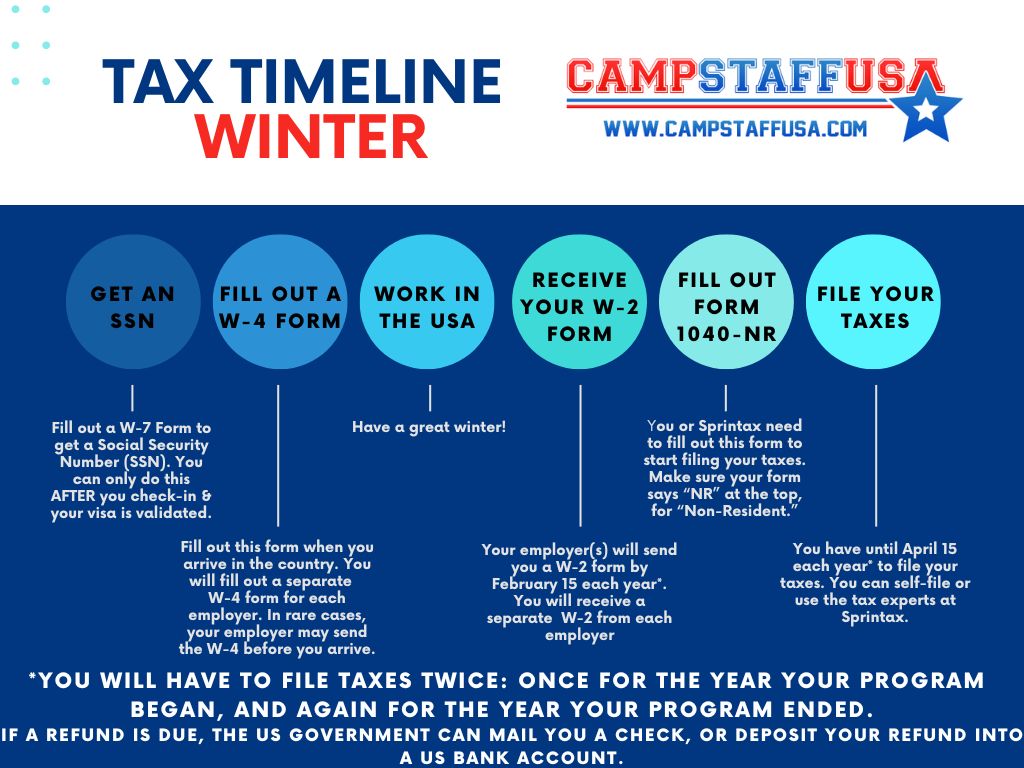

Exchange visitors are considered Non-Resident aliens, therefore you will need to file a Form 1040NR.

Taxes must be filed by April 15th unless you file for an extension.

US employers are required to issue a W-2 (Wage and Tax Statement) form summarizing your overall earned income and withheld taxes for the previous year by February 15th. If you do not receive your W-2 by February 15th, contact your employer immediately. If you do not hear from your employer, contact your sponsor.

Taxes must be filed before April 15th of the following year unless you file for an extension. If you file AFTER April 15th and you did not file an extension request, you may be assessed interest and penalty fees.

https://www.irs.gov/individuals/international-taxpayers/taxation-of-nonresident-aliens

https://www.irs.gov/forms-pubs/about-form-1040-nr

TAX FILING OPTIONS

1. Complete your own tax return. Federal AND state (where applicable)

Federal Tax Filing: You can file your federal income tax return using the 1040-NR-EZ form: https://form-1040-nr.com.

State Tax Filing: State and local tax forms vary by state. Some states don’t impose income tax and, therefore, may not require a tax return. https://www.taxadmin.org/state-tax-forms. The IRS also provides links and information for filing taxes in your host state. If you worked in more than one state, you need to file state taxes for each state you worked in.

2. Employ a tax agent to assist you in filing your tax return/s and to answer any questions you have.

eFile is an IRS authorized Electronic Return Originator (ERO). They offer a secure online platform for the preparation and electronic filing of tax returns and they offer discounted prices to our participants. Here is the link with instructions and the codes you will need for the special price: https://www.efile.com/special-efile-program/

Sprintax also provides easy-to-use, online software that ensures compliance with US regulations. They provide reliable services and they work in partnership with Universities and other J1 programs already. Create an account now: https://taxprep.sprintax.com/campstaffusa. A member of the Sprintax team will contact you once you’ve created an account. If you have any questions, you can email them as well at [email protected]

Refunds and/or Owed Taxes: If you are owed a refund, the US Government will either deposit the refund into a US bank account that you registered or issue you a paper check to be mailed to you. If it turns out that your employer did not deduct the taxes you are liable for, YOU MAY OWE the IRS money. In this case, you will have to follow instructions on how to make the appropriate payment and mail the payment with your filing.

All J1 participants who earned even $1.00 in the US are required to file a US federal tax return before April 15 of the following year. Failure to file a Federal tax return will breach IRS regulations and may result in accrued penalty fees and interest and can possibly result in future visa denials so this is very important. In cases where a foreign national is applying for a different visa or green card, proof of previous tax returns is often required for consideration. Depending on the state you worked in, you may be required to also file a specific state and/or local tax return as well.

Be careful of other tax agencies. Other online providers such as Turbo Tax are not suitable for non-resident aliens. Turbo Tax even makes it clear on their site. Other tax agencies may advertise a full or partial refund of Federal taxes even for J1 participants. That is simply not true. You MUST file the 1040NR (non-resident). Please note that if you use any such providers and they intentionally or unintentionally provided false or misleading information, it is YOU who will be in breach of IRS regulation and risk being audited and incurring fines or penalties on incorrect refund amounts.

NOTE TO ALL: Be cautious of individuals or companies offering to file your tax returns. We’ve been made aware of information provided by the IRS on warning signs of “ghost preparers” and tax scams:

https://www.irs.gov/newsroom/beware-of-ghost-preparers-who-dont-sign-tax-returns.

https://www.irs.gov/newsroom/tax-scams-consumer-alerts

SPECIAL NOTE TO OUR WINTER PARTICIPANTS

Because you have received earnings in both calendar years, you will be required to file taxes for both years.

IN PREPARATION OF FILING YOUR TAXES

You should have completed a W-4 (Employee’s Withholding Allowance Certificate) during orientation/on-boarding. Here are instructions for J1 participants. Supplemental Form W-4 Instructions for Nonresident Aliens. Your taxes are calculated and deducted based on the information you provide in that form. In order to file a tax return you will need a tax filing number which is either a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). If you did not apply for an SSN or if you did not receive your SSN for any reason, you can apply for an ITIN by completing a simple W-7 form.

English version: https://www.irs.gov/pub/irs-pdf/fw7.pdf

Spanish version: https://www.irs.gov/pub/irs-pdf/fw7sp.pdf

If you were not able to obtain an SSN while you were in the US, you should apply for an ITIN, but be sure to choose the correct reason for the filing. Instructions for completing this form can be found here: https://www.irs.gov/forms-pubs/about-form-w-7